Sunrun (Nasdaq: RUN) delivered its Q2, 2024 earnings, meeting analyst expectations for revenue and delivering promising guidance for cash generation in 2025.

The residential solar and energy storage provider reported $524 million in revenue for the quarter, in-line with Wall Street expectations. The company delivered a surprise earnings per share of $0.55, up from the expected loss ($0.40). The stock is trading up roughly 15% during the trading session post-earnings report.

For businesses in the residential solar industry, generating cash and cover debts has become an area of focus for investors. Sunrun had a strong performance in this area, generating $217 million in cash in Q2. The company reiterated its guidance of $50 million to $125 million in cash generation in Q4 and introduced guidance of $350 million to $600 million in 2025.

Sunrun added 26,687 customers in the second quarter, about 94% of which were lease or power purchase agreement customers. Annual recurring revenue from subscribers was approximately $1.5 billion as of June 30, 2024.

Net earning assets increased to $5.7 billion, including over $1 billion in total cash.

Sunrun posted strong execution in capital markets, as well, closing an $886 million securitization of residential solar and battery systems. The two classes of non-recourse Class A senior notes were rated A+ by Kroll with the $443.15 million public Class A-1 note priced at a credit spread of 205 basis points. The Class A notes represented an advance rate of approximately 72.6%.

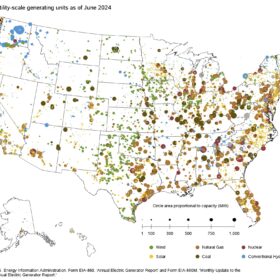

Energy storage capacity installed reached 192 MW in Q2, reaching prior expectations. Sunrun now has 7.1 GW of networked solar energy capacity.

“In the second quarter we again set new records for both storage installation and attachment rates, further differentiating Sunrun in the industry, beating the high-end of our storage installation guidance and delivering solid quarter-over-quarter growth for solar installation, Cash Generation and Net Subscriber Value,” said Mary Powell, Sunrun’s Chief Executive Officer.

Energy storage attachment rates increased to 54%, up from 18% in the same period in 2023. Sunrun has now installed more than 116,000 solar and storage systems, representing nearly 1.8 GWh of stored energy capacity.

Sunrun also launched a partnership with Tesla to support the Texas power grid. More than 150 Sunrun customers have enrolled in a virtual power plant (VPP) program to be compensated for dispatching electricity from their batteries to the grid when power is needed most. Additionally, during prolonged power outages in the aftermath of Hurricane Beryl, more than 1,600 Sunrun customers in the greater Houston area were able to keep their homes energized with more than 70,000 hours of backup energy provided by their solar-plus-storage systems.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.