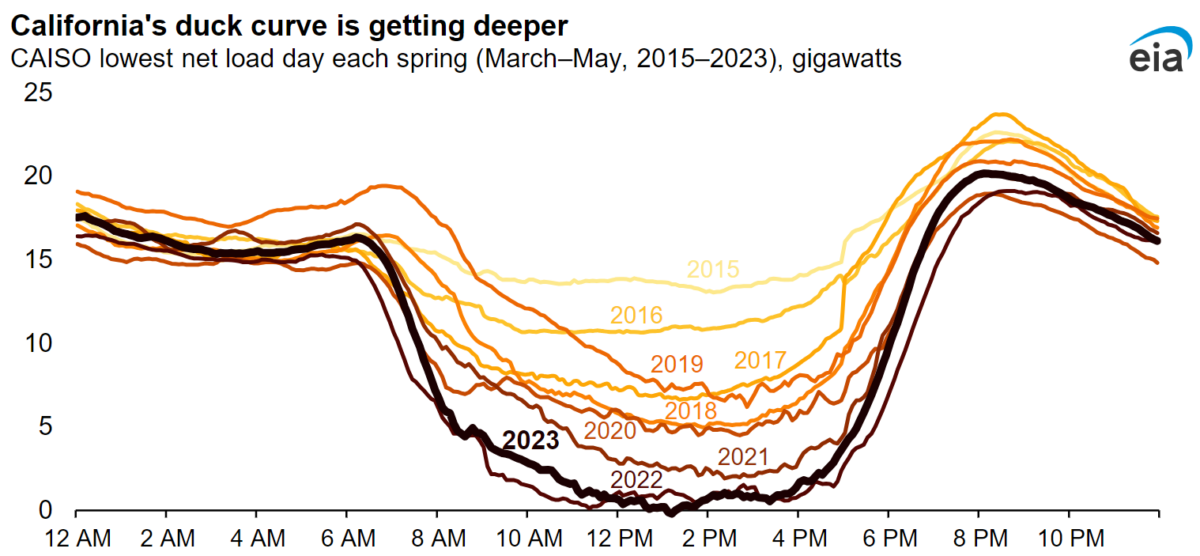

The phenomenon of the “duck curve” is an electric grid operation concept that signifies the mismatch between peak solar generation (mid-day to afternoon) and peak electricity demand (late afternoon and evenings). Shaped like the outline of a duck, the curve shows the peaks and valleys of this mismatch throughout a typical day.

The experience of a duck curve can cause stress on the grid and challenges for the electricity market, causing California and other solar-friendly states to boost adoption of energy storage to meet these challenges.

The Energy Information Administration (EIA) shared that as solar adoption grows in California, the “duck curve” is deepening. The midday dip in net load is getting lower, making it more difficult for the California Independent System Operator (CAISO) to balance the grid.

The swing in demand for electricity from conventional power plants from midday to late evenings, when energy demand is still high but solar generation has dropped off, means that conventional power plants like natural gas-fired peaker plants must rapidly ramp up electricity production to meet demand. That rapid ramp up makes it more difficult for grid operators to match grid supply with grid demand in real time, a mechanism that balances the grid both physically and in the wholesale marketplace.

Additionally, if more solar power is produced than can be used, operators may have to curtail, or deliberately shut off, solar assets to avoid over generation. The California Independent System Operator (CAISO) curtailed 1.5 million MWh of utility-scale solar in 2020, representing 5% of total production, according to EIA. Solar is by far the most dominant source of energy that undergoes curtailment in the state. EIA said 94% of power curtailments in 2020 involved solar energy.

Curtailments reach a peak in the spring months, where demand is relatively low and solar output is relatively high. For example, in the early afternoon hours of March 2021, an average of 15% of utility-scale solar was curtailed, CAISO data showed as reported by the Energy Department.

EIA also warned that the duck curve scenario also challenges traditional, dispatchable energy sources by making it uneconomical to operate them around the clock. This harm to a given facility’s revenue may lead to a retirement of the facility without a highly dispatchable replacement, the EIA said.

“Less dispatchable electricity makes it harder for grid managers to balance electricity supply and demand in a system with wide swings in net demand,” said EIA.

However, the duck curve has opened the door for energy storage to meet the grid-balancing needs of California and other renewables-based economies.

“The large-scale deployment of energy storage systems, such as batteries, allow some solar energy generated during the day to be stored and saved for later, after the sun sets,” said EIA. “Storing some midday solar generation flattens the duck’s curve, and dispatching the stored solar generation in the evening shortens the duck’s neck.”

Battery energy storage in California has quickly grown from 600 MWh in 2018 to nearly 15.5 GW today, said EIA. Operators plan another 14 GWh of storage capacity in the state by the end of the year according to EIA data, suggesting the solar-plus-battery boom has only just begun.

Despite its higher total project costs, solar-plus-storage has an advantage in capture price, said global risk assurance firm DNV. Plants with storage can charge their batteries when sunlight is plentiful during the day and sell the stored electricity when the price is high. DNV said that by 2038, the capture price advantage of solar and storage co-located projects will surpass the cost disadvantage, making these projects even more attractive.

“PV and storage systems are designed as a ‘package’ that can produce energy on demand, just like hydropower, nuclear, or combustion power plants,” said DNV.

In 10 years, DNV said roughly 20% of solar projects worldwide will be built with dedicated storage, and by mid-century such projects will reach about 50%.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“Battery energy storage in California has quickly grown from 200 MW…” I can’t tell what you mean here.

Energy is measured in megawatt-hours or MWh. Is that what is meant?

Power is measured in megawatts or MW, and that is what the duck curve’s vertical axis represents (though in gigawatts, which is thousands of MW). Do you mean batteries could drive 200 MW of power? If so, for how long? All night, or just part of the night?

Not trying to be pedantic. Those are very different things. I only care because the rest of the article is so well written, and I’m very interested in how effectively and economically batteries can balance intermittency of solar and wind power since the generation cost is otherwise so low.

Thank you for pointing this out. We were able to find the GWh ratings in EIA’s 860M data table and changes are reflected in the article.

I would like to see more discussion on the issue of capture cost. I think this is capturing higher pay back electricity prices when demand is high and supply of power is low. What I see is that levelized cost of electrical generation does not necessarily leads to profitablity, especially if the highest outputs are discarded because of over production. What I would like to see is some sort of profitablity measure of the electrical power produced.

Battery storage facilities have both a power rating (MW) and an energy rating (MWh). The power rating defined the inverter capacity in the plant, which defines how much power the unit can supply to the grid or absorb from it when charging. The energy rating defines how much chemical energy the battery can store, expressed in MWh, and when combined with the power rating, the energy rating defined how long the battery can supply electricity. As examples, a unit with a power rating of 20 MW and an energy rating of 200 MWh could supply 20 MW of power for about 10 hours. A unit with a power rating of 10 MW and an energy rating of 200 MWh could supply 10 MW for about 20 hours.

The sensible way to address the duck curve is for work place charging of EVs during times of peak solar generation. Then balance the peak load by Vehicle to Grid (V2G) at peak hours. Tapping only 10% of vehicle storage with a million EVs can provide 10 gigawatts of peak draw. (10 KW per car times 1 million cars = 10 million KW or 10 GW).

Sadly Tesla doesn’t offer this capability now but most other manufacturers do.

Three things must happen. Widely available workplace charging, a mandate that cars have V2G, and hardware available during peak usage hours to feed power back to the grid.

As this solution does not involve big money for utility scale battery storage, the politicians bought and paid for by relevant industries will resist this, probably even in California.

I believe Finland is at the forefront for this technology.

Sincerely,

David Rubin

California doesn’t have a million EVs. As of 2022, there were just about 300,000.

And the peak excess available was on a Sunday, but even forgetting that, you would expect about a 4 GWh charging draw per average day, assuming about 25,000 km a year x 0.2 KWH per km x 300,000 cars ÷ 365 days.

Spread over the 6 hours of low load during the solar day, it’s just 0.7 GW of additional load assuming *all* charging was done in daytime.

No, V2x isn’t going to be the big game-changer. If California had 5 to 10 times as many EVs that mostly charged during the day, plus stationary storage, they wouldn’t have curtailment, even without V2L or V2H.

Improvements to the grid will also help. That peak ‘excess’ solar can be sold further east where their peak usage times happen earlier, just as California’s production peaks.

CA consumer power costs are some of the most expensive in the country and massively expensive battery arrays are not going to help that.

So, California needs to invest in that crab shell battery (research about it just came out this week)

Or we could open up more nuclear power plants…

Using 10% of a typical EV battery at 10kW will only last 40 min. Your 10 GW figure is very misleading.

Widely available workplace charging is expensive. Every home charger is used every few days by an EV owner. Getting 1 million bidirectional chargers installed among the workplaces of 20 million employees with high usage is impossible. Some won’t have enough chargers and some will have too many (as employees change jobs), some won’t be in convenient parking spots, and it’s only useful during duck-curve seasons. There will be all sorts of grid bottlenecks getting power from high EV ownership areas to high consumption areas. Multiply everything together and you’re looking at very high cost per useful kWh delivered.

Finally, the best use of non-infinite EV cycle life is to displace gasoline combustion (1-1.5 kg/kWh), not natural gas (0.5 kg/kWh). Even if V2G use only degrades battery life by a year, it still reduces total emissions reduction potential per EV.

V2G just isn’t worth the capital expense.

Better to just use batteries made for stationary use, such as those installed at fast charging stations.