A flourishing new market has grown out of the key policy changes set forth by the Inflation Reduction Act (IRA) of 2022, making more capital available for clean energy developers. The IRA created a pathway for clean energy developers to sell their federal tax credits to third parties in exchange for cash, thereby accelerating investment. The first transactions under this new provision occurred in January 2023.

Tax credit transfer marketplace operator Crux released a mid-year Market Intelligence Report, noting a larger-than-expected market for tax credit sales in 2024. Crux tracked $6.8 billion specific transactions in the first half of 2024, corresponding to an estimated $9 billion to $11 billion of transactions closed so far this year nationwide.

Crux said that by year’s end, U.S. clean energy tax credit transactions will total $20 billion to $25 billion.

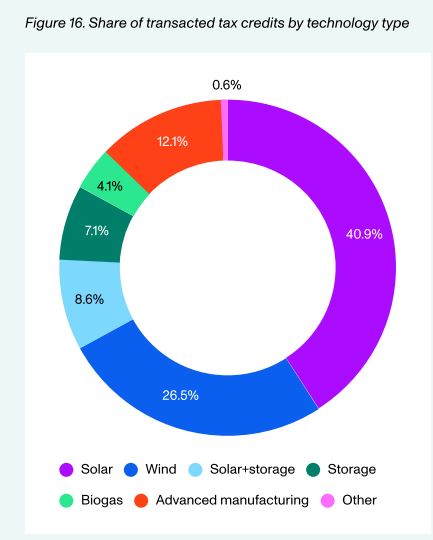

The marketplace operator said that established technologies accounted for most of the transactions this year, with wind, utility-scale solar, energy storage, and advanced manufacturing credits accounting for 95% of the reported deals. Crux said that in the second half of 2024, distributed generation, residential solar projects, additional 45X manufacturing credits, and “renewable” natural gas (RNG) may participate and contribute to an even larger market size.

Solar had the largest share in supply of tax credits available, representing about 41% of the total. Solar and storage hybrid projects represented another 9% of total tax credit supply.

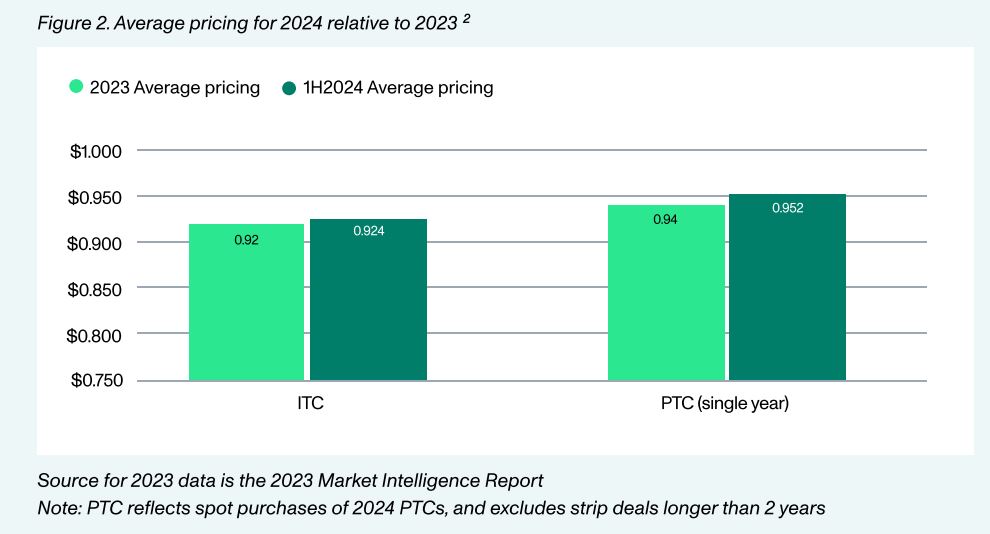

Pricing for the first half was “strong” according to Crux, with average Production Tax Credit (PTC) deals fetching $0.95 per dollar of tax credit value, $0.925 for Investment Tax Credit (ITC). This compares to $0.94 and $0.92 respectively in 2023.

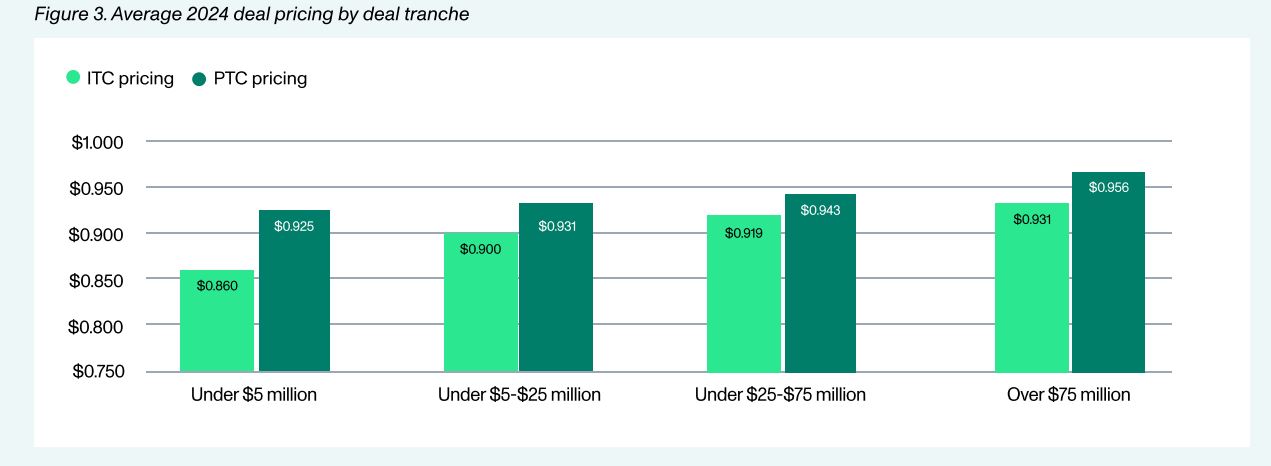

Average deal size reported by Crux was $55 million for ITC deals and $85 million for spot PTC deals. In 2023 average deal sizes were $20 million and $60 million, respectively. Despite this, pv magazine USA has reported on smaller tax credit deals being made, suggesting that there is an appetite for tax credit sales of all sizes.

Crux said that deal size and insurance continue to play dominant roles in market pricing. Small to mid-sized deals valued between $5 million and $25 million saw lower average pricing than the market overall with $0.937 for PTC and $0.918 for ITC on average. It said the use of insurance in ITC deals, though common, tends to be correlated with lower pricing compared to deals with parent indemnification, especially for deals lower than $25 million.

The marketplace provider said buyers are now beginning to look out to 2025 tax credit deals, with data indicating that forward commitments tend to transact at a one to three cent discount to 2024 deals. About 25% of 2024 reported deals included a forward component, including a full or partial purchase of future year tax credits, said Crux.

“This market has continued to grow in size, technological diversity, and depth, driving billions of dollars of new private sector investments into energy infrastructure and domestic manufacturing,” said Alfred Johnson, co-founder and chief executive officer of Crux. “These investments have created jobs and driven a new wave of American technological innovation. We are seeing new participants enter the market every month, market standards taking shape, and all facets of the market becoming more transparent and efficient.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.