Duke Energy announced an agreement to sell its commercial distributed generation business to an affiliate of ArcLight Capital Partners for an enterprise value of $364 million. The North Carolina utility said it expects about $259 million of net proceeds from the transaction.

The deal represents the second solar divestment of the year for the utility. In early June, Duke reached an agreement to sell its utility-scale renewables business platform for $2.8 bilion to Brookfield Renewable. The company expects to finalize the sales for its utility and distributed-generation solar businesses by the end of 2023. It said it plans to use sale proceeds to lower balance sheet debt.

The two divestments support Duke’s focus on the growth of its regulated businesses, including investments to enhance grid reliability and incorporate over 30 GW of regulated renewable energy into its grid by 2035.

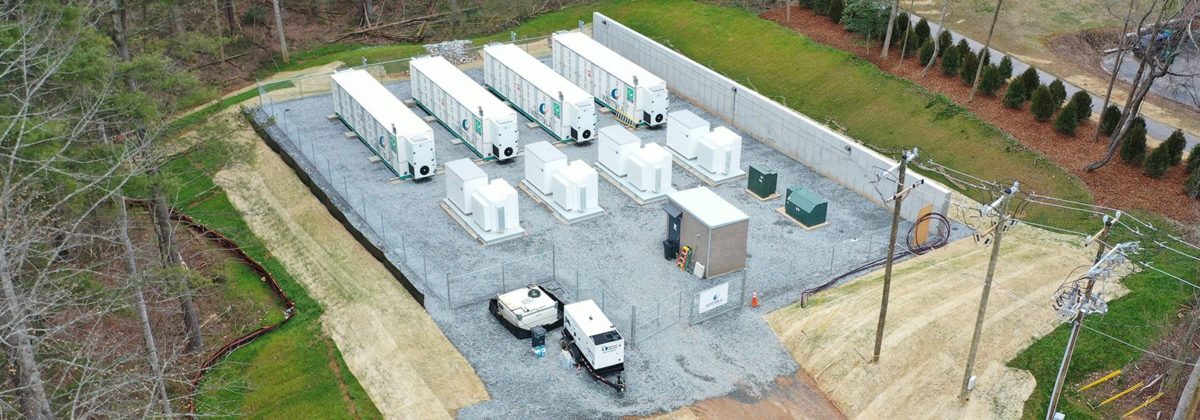

The distributed-generation business being sold includes REC Solar operating assets, development pipeline and O&M portfolio, as well as various fuel cell projects managed by Bloom Energy. Employees of the distributed generation business will transition to ArcLight to maintain business continuity for its operations and customers.

Duke initially acquired the REC Solar commercial DG business in February 2015 for about $225 million.

“The sale of our commercial renewables businesses streamlines our portfolio and provides the resources to support the long-term needs of our customers in our growing regulated territories,” said Lynn Good, president and chief executive officer of Duke Energy. “Over the next decade, we plan to invest significant amounts of capital to fund the critical energy infrastructure necessary to serve our customers and support our clean energy transition.”

“This transaction leverages ArcLight’s deep experience in investing across the renewables infrastructure sector and utilizing our value-added approach to help drive asset optimization, which allow us to further build upon the portfolio and advance brownfield development opportunities,” said Dan Revers, managing partner of ArcLight.

The sale is subject to closing conditions, including a waiting period under the Hart-Scott-Rodino Act, as well as approval by the Federal Energy Regulatory Commission for the sale of Bloom Energy fuel cell assets.

Bank of America Securities is financial advisor and Mayer Brown LLP is legal advisor to Duke Energy for the divestment. Scotia is financial advisor and Kirkland & Ellis is legal advisor to ArcLight Capital, a Boston-based energy private equity firm invested in $27 billion of transactions since 2001.

Earlier this year, Duke Energy sold its utility-scale solar development business to Brookfield Renewables, which includes a 3.4 GW pipeline of wind, solar and energy storage assets in various stages of development. The utility had previously put a $4 billion valuation on its broader utility-scale renewables business.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.