The U.S. Treasury has unveiled proposed guidelines for the 45X Advanced Manufacturing Production Credit. Full guidelines can be found here.

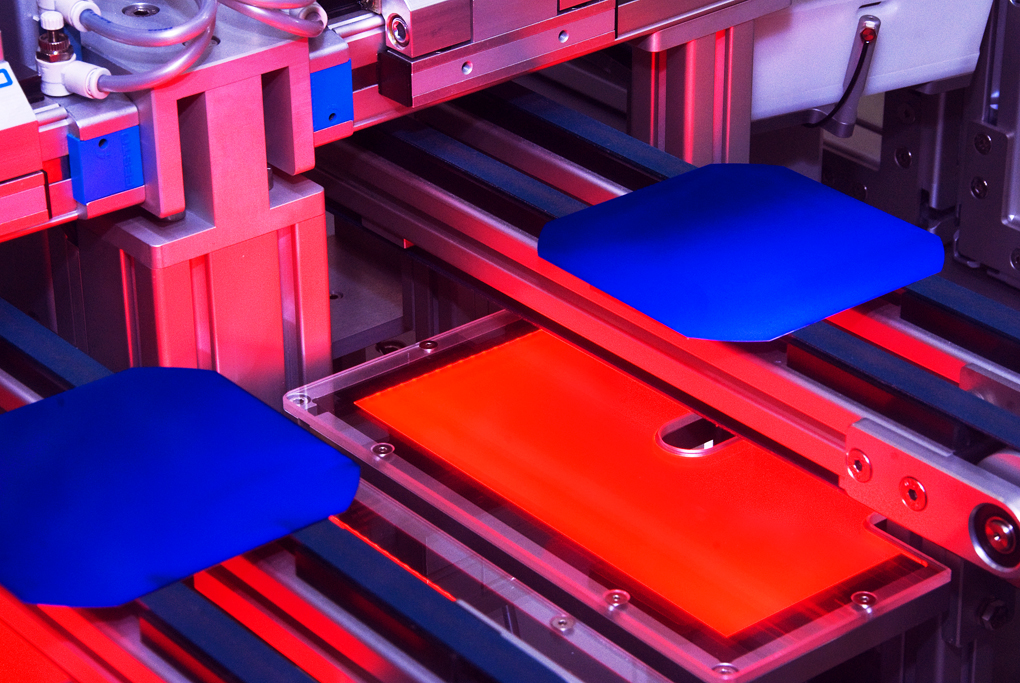

The tax credits, made available as part of the $369 billion in climate and energy spending set forth by the Inflation Reduction Act of 2022, are designated for clean energy components manufactured in the United States. Credits are paid at a varying dollar per Watt rate and are organized by component classification.

The law creates production tax credits for various clean energy components through 2032.

The Solar Energy Industries Association (SEIA) celebrated the new guidance. Specifically, it said the inclusion of contract manufacturers for credit eligibility was a strong move that will further accelerate U.S. clean energy manufacturing.

“America is undergoing the largest expansion of domestic solar manufacturing in history, and today’s developments will help support this economic boom,” said Abigail Ross Hopper, president and chief executive officer, SEIA.

The guidance also provides credits for power optimizers, a boon for providers like SolarEdge. Power optimizers will be offered the same 11 cent per Watt credit as long as they are sold together with a DC-optimized inverter.

Language in the issued guidance suggests that manufacturers like U.S.-based First Solar will be eligible for a credit at the wafer, cell, and module level, meaning that it will be able to take advantage of a $0.175 per Watt credit, said Roth Capital Partners.

Lucrative tax credits have been attracting clean energy manufacturers worldwide to build factories in the United States. Now with the guidance issued, these companies can begin to move forward with their plans.

(Read: “’The times of supply shortage are over,’ solar giants bet big on U.S. manufacturing”)

“Over the past year, nearly $100 billion in clean energy manufacturing investments have been announced, with plans for close to 100 new facilities across the U.S.,” said José Zayas, executive vice president of policy and programs for the American Council on Renewable Energy (ACORE).

“However, this remarkable progress is only just beginning,” said Zayas. “Projections show the Section 45X manufacturing tax credit will help spur billions of dollars in new economic activity over its life.”

The guidelines will undergo a 60-day period of public comment before final guidance is issued.

Summary of IRA manufacturing incentives

| 100% | 75% | 50% | 25% | 0% | |

|---|---|---|---|---|---|

| 2022-2029 | 2030 | 2031 | 2032 | 2033 | |

| Solar | |||||

| PV modules | 7 ¢/Wdc | 5.3 ¢/Wdc | 3.5 ¢/Wdc | 1.8 ¢/Wdc | 0 ¢/Wdc |

| PV cells | 4 ¢/Wdc | 3 ¢/Wdc | 2 ¢/Wdc | 1 ¢/Wdc | 0 ¢/Wdc |

| PV wafers | $12/m2 | $9/m2 | $6/m2 | $3/m2 | $0/m2 |

| Solar grade polysilicon | $3/kg | $2.25/kg | $1.50/kg | $0.75/kg | $0/kg |

| Polymer backsheets | $0.40/m2 | $0.30/m2 | $0.20/m2 | $0.10/m2 | $0/m2 |

| Inverters* | |||||

| Central inverter | 0.25 ¢/Wac | 0.19 ¢/Wac | 0.13 ¢/Wac | 0.06 ¢/Wac | 0 ¢/Wac |

| Utility inverter | 1.5 ¢/Wac | 1.13 ¢/Wac | 0.75 ¢/Wac | 0.38 ¢/Wac | 0 ¢/Wac |

| Commercial inverter | 2 ¢/Wac | 1.5 ¢/Wac | 1 ¢/Wac | 0.5 ¢/Wac | 0 ¢/Wac |

| Residential inverter | 6.5 ¢/Wac | 4.88 ¢/Wac | 3.25 ¢/Wac | 1.63 ¢/Wac | 0 ¢/Wac |

| Microinverter | 11 ¢/Wac | 8.25 ¢/Wac | 5.5 ¢/Wac | 2.75 ¢/Wac | 0 ¢/Wac |

| Trackers | |||||

| Torque tube or longitudinal purlin | $0.87/kg | $0.65/kg | $0.44/kg | $0.22/kg | $0/kg |

| Structural fasteners | $2.28/kg | $1.71/kg | $1.41/kg | $0.57/kg | $0/kg |

| Batteries | |||||

| Electrode active materials** | 10% | 7.5% | 5% | 2.5% | 0% |

| Cells ($/kWh) | 35 | 26.30 | 17.50 | 8.80 | 0 |

| Modules ($/kWh) | 10 | 7.50 | 5 | 2.50 | 0 |

| Modules that don’t use cells ($/kWh) | 45 | 33.80 | 22.50 | 11.30 | 0 |

| Modules ($/kWh) | 10% | 7.5% | 5% | 2.5% | 0% |

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.