Hyzon Motors, a New York State-based supplier of hydrogen fuel cell-powered commercial vehicles, signed a memorandum of understanding for a joint venture with renewable fuels company Raven SR. The two plan to build up to 100 hydrogen production hubs across the United States and globally. As part of the deal, Hyzon will acquire a minority interest in Wyoming-based Raven.

Each hub is expected to convert organic waste into hydrogen for Hyzon’s commercial vehicles. Raven owns a portfolio of patents for a conversion process that involves no combustion, which the company said avoids creating pollutants and particulates while producing more hydrogen per ton of waste than competing processes.

The hubs are planned to be built at landfills and are expected to power garbage trucks and other classes of heavy-duty trucks. The first hub is planned to be built in the San Francisco Bay Area, and is expected to be commissioned in 2022.

Conversion costs are expected to be similar to hydrogen produced using hydrocarbons, so-called “gray” hydrogen. The initial hubs are expected to process 50 tons of solid waste daily, per hub, and are expected to yield up to 4.5 tons of renewable green hydrogen each, enough to power 100 commercial vehicles. Future hubs may scale to five times larger to handle sites with higher hydrogen requirements.

Last October, Total Carbon Neutrality Ventures, the venture capital arm of Total SE, and other specialist hydrogen investors made an investment in Hyzon. The company operates out of the former General Motors fuel cell facility in Honeoye Falls, New York, near Rochester. The company has European operations in the Dutch city of Groningen with JV partner Holthausen Clean Technology.

Hyzon expects to deliver around 5,000 fuel cell trucks and buses over the next three years. By 2025, Hyzon’s capacity is expected to be more than 40,000 fuel cell vehicles annually.

400 localities are SolSmart

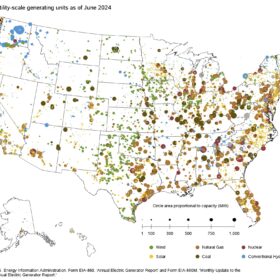

Over 400 municipalities, counties, and regional organizations have now achieved designation under SolSmart, a federally funded program that helps local governments make it faster, easier, and more affordable to go solar.

SolSmart communities are in 41 states, the District of Columbia, and the U.S. Virgin Islands. SolSmart is led by The Solar Foundation and the International City/County Management Association, and funded by the U.S. Department of Energy Solar Energy Technologies Office. Launched in 2016, SolSmart is a national designation program designed to recognize communities that have taken steps to address local barriers to solar energy and foster the growth of mature local solar markets. The program offers technical assistance at no cost.

A new study from Missouri University of Science & Technology, Florida State University, University of Miami, and University of Texas at Austin found that SolSmart designees added between 300-450 MW of solar capacity and 12,800-19,200 new installations nationwide. That translates the $10 million in taxpayer funds for SolSmart into $1-2 billion in additional solar investment. The study also found that SolSmart speeds up the permit process for solar installations by 7.5 days on average.

Indiana solar sale

Tri Global Energy said it will sell the 400 MW Honey Creek Solar project and the 180 MW Hoosier Line Wind project to Leeward Renewable Energy, which owns and operates a portfolio of around 2,000 MW of generating capacity. Financial terms were not disclosed.

The projects are located in White County in northwestern Indiana and are targeted to be operational as early as 2023. They represent the first deal between the two Dallas-based companies and the first renewable project sales for Tri Global Energy in Indiana.

Since the origination of these projects in 2019, Tri Global Energy has been the project developer. The company will continue as a co-development partner under the sale arrangement.

Battery startup secures financing

Battery tech company Gridtential Energy announced $12 million in financing led by 1955 Capital with participation from Silicon Valley Bank, August Capital cofounder David Marquardt, ReneSola CEO Yumin Liu, and existing investors East Penn Manufacturing, Crown Battery, and the Roda Group.

The funding will support a new production line of lead reference batteries, including a factory-ready single-block 24V deep-cycle lead battery. Gridtential has raised $28 million to date.

The company is targeting its battery for personal mobility vehicles such as golf carts, scooters, e-bikes, and e-tuk-tuks, as well as RVs and telecom backup or renewable energy storage systems in homes and offices.

Gridtential created its Silicon Joule battery as an alternative to lithium-ion and based it on readily available lead-battery technology and solar materials. Silicon Joule replaces the metal grids in conventional lead batteries with silicon wafers and a stacked-cell architecture. The goal is to reduce weight, increase power performance, and extend cycle life.

The company said that its Silicon Joule batteries charge up to two times faster, last more than four times longer, and weigh up to 30% less than conventional lead batteries. The batteries also maintain the thermal stability and 99% recyclability of the conventional technology.

Manufacturers East Penn, Crown, and Leoch are licensed to mass-produce the batteries. Nine more partners — mostly international — are piloting the technology, the company said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.