From pv magazine Global

In the Chinese market, the majority of module sellers OPIS surveyed said the TOPCon FOB China market was quiet and prices were stable although there were some buyers out in the market talking down prices. Market talks of TOPCon prices below $0.09/W FOB China were circulating in the market, with one buyer pointing out that there were offers of Grade A TOPCon cargoes with a power output of 580-585 W of cargo sizes above 10 MW being offered at $0.081-0.086/W. However, sellers OPIS surveyed said there were no transactions at this level.

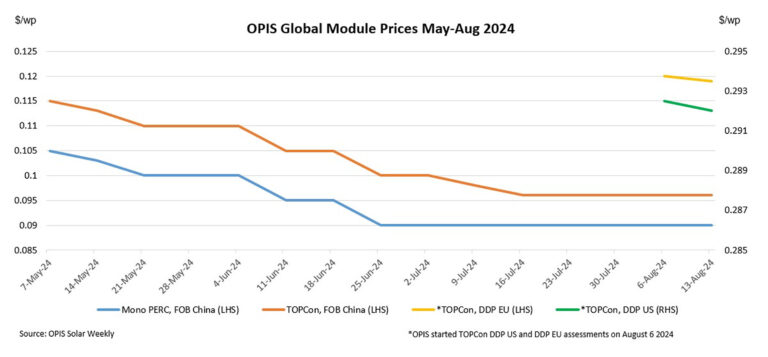

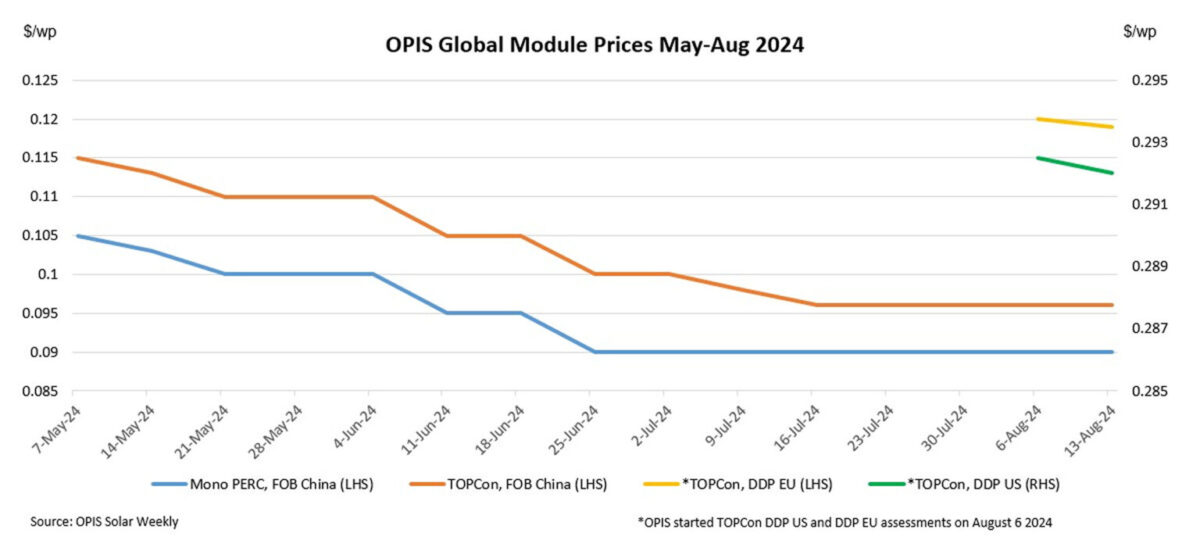

Most market discussions continued to be heard at $0.095-0.10/W FOB China. The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China was assessed at $0.096/W unchanged from the previous week while Mono PERC module prices were assessed stable week-to-week at $0.090/W.

Bearish sentiment prevailed in the Chinese domestic market as recent large-scale public tenders such as China Coal Group’s 4 GW procurement tender had attracted low offers of CNY0.7134 ($0.100)/W for N-type modules and CNY 0.7104/W for P-type modules with many market participants expecting module prices to fall to CNY0.70/W levels in the coming weeks, an industry source said. Mono PERC module prices were assessed at CNY0.777/W, stable from the previous week while TOPCon module prices were assessed unchanged at CNY0.801/W week-to-week.

In the European market, OPIS assessed the TOPCon modules delivered into Europe lower on the week at €0.109 ($0.12)/W, with indications ranging from €0.100/W to €0.120/W While delivered prices have eased in recent weeks due to a seasonal lull, a market source noted that August freight rates are still hovering at high levels compared to the previous few months.

According to OPIS records, August freight rates from China to Rotterdam are around $7000 to $8000 per forty-foot equivalent unit (FEU), approximately $0.0189/W to $0.0192/W, which is 30% higher compared to June. According to a European trade source, TOPCon modules up to Q2 2025 delivery were heard to be around €0.100/W to €0.110/W depending on the project size.

In the U.S. market, spot prices for U.S. delivered duty-paid (DDP) TOPCon modules fell this week to $0.291/W, with indications from $0.260/W to $0.320/W, while prices for Q1 2025 delivery averaged $0.311/W, ranging between $0.280/W and $0.350/W. OPIS assessed the U.S. mono PERC Q4 delivery module prices at $0.249/W, with indications between $0.200/W to $0.295/W, while 2025 delivery cargoes were around $0.27-0.34/W.

A major U.S. buyer said that prices of TOPCon modules from India and Southeast Asia scheduled for shipment this year have dropped recently. Another North American source noted growing concern among developers as autumn nears, particularly regarding the heightened tariff risk from Southeast Asia. Trade officials significantly broadened the scope of AD/CVD investigations this spring, increasing the likelihood of finding anti-market behavior in the four targeted countries. The White House has yet to clarify whether there will be tech exemptions or grace periods.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.