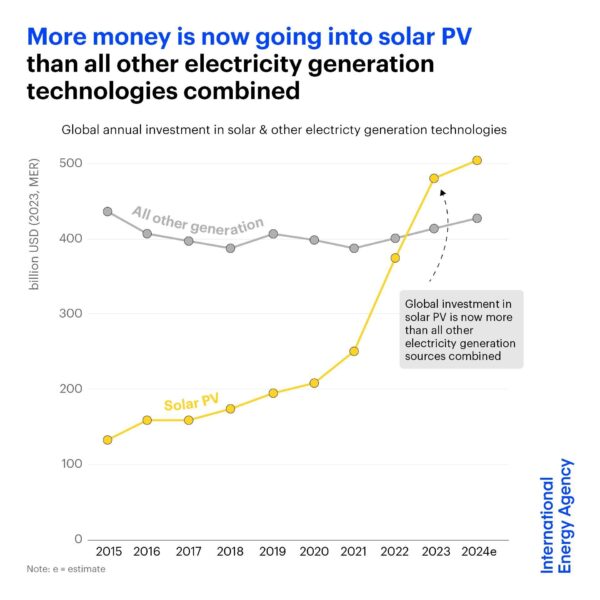

The International Energy Agency (IEA) projects that investment in solar photovoltaics will exceed $500 billion in 2024, surpassing the combined investment in all other electricity generation sources.

According to the World Energy Investment 2024 report from the IEA, total energy spending, including fuels and infrastructure, will exceed $3 trillion for the first time this year. Of that, $2 trillion will be directed toward clean energy technologies.

Clean energy technology investments are rising globally, with China leading the way, but significant increases in spending are evident across all continents. Overall, investment in renewable electricity generation is expected to reach a moderate $770 billion.

The $770 billion figure is considered “moderate” because the precipitous drop in solar panel prices has slowed the dollar increase in solar investment, even as capacity continues to grow rapidly. The chart above shows that more money is going into solar than all other forms of generation combined, reaching $500 billion in 2024.

The IEA notes that in 2023, each dollar invested in wind and solar PV yielded 2.5 times more energy output than a dollar spent on the same technologies a decade ago.

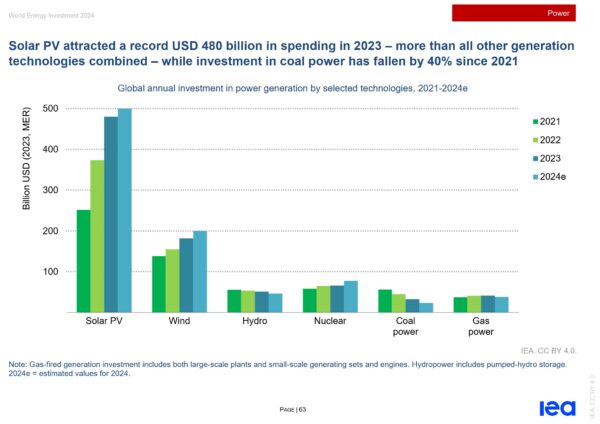

Globally, fossil fuel generation investments are projected to reach $80 billion for new generation facilities, with coal investment falling by 30% and gas decreasing by 8% compared to 2023 levels. The largest portion of the overall $3 trillion will be spent on fuel purchases, nearly $1.1 trillion, with only a small single-digit percentage going to low-emission fuels.

Investment in wind is expected to reach $200 billion, nuclear could touch $80 billion, which is double its 2018 investments. Battery storage is projected to reach $50 billion.

Private household investment in energy doubled from 9% of the total in 2015 to 18% at the end of 2023, driven largely by spending on rooftop solar, building efficiency, and electric vehicles. Since 2016, households have accounted for “40% of the increase in investment in clean energy spending,” which the IEA says is the largest share by far. Advanced economies saw 60% of their growth coming from private decisions, bolstered by strong policy support.

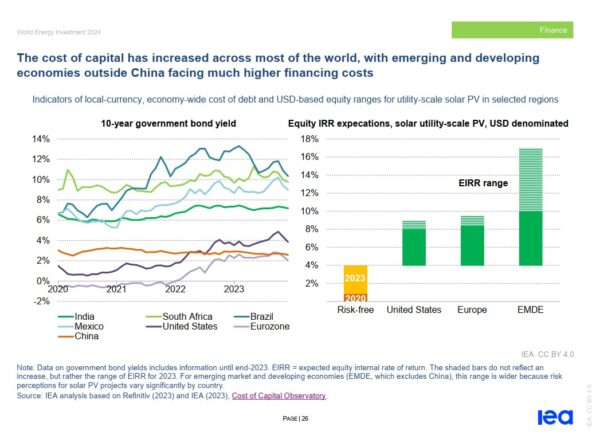

The moderating effect of falling hardware prices for solar panels, energy storage, and, to a lesser extent, wind turbines, has significantly offset the increased cost of capital.

Even with increased capital costs, and while hardware manufacturers face financial challenges, renewable projects themselves are seeing improved profitability. The IEA reports that returns on investment capital increased by one-third in 2023 compared to the previous year, due to the declining costs of hardware. The decrease in solar module prices on its own has lowered the projected levelized cost of electricity for solar power facilities by 5%, with energy storage projects experiencing even greater payback improvements due to their own price collapses.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.