With expectations of about 10 GW of utility-scale and 3 GW of residential solar in 2020, according to BNEF, the U.S. solar industry has been able to thrive despite unprecedented headwinds. Here’s a list of solar lessons learned in 2020.

Utility-scale solar shows its strength

If there’s one solar segment that can weather a pandemic, it’s utility-scale photovoltaics. Supply chains suffered some delays in the early days of the pandemic, but they’ve recovered and are now in full swing. It’s easier to socially distance on a 1,000-acre solar project than on a residential rooftop, and solar EPC firms like Rosendin and Swinerton are growing their renewables businesses as fast as they ever have.

IHS Markit finds that by the end of July 2020, the U.S. had installed nearly 6 GW of large-scale solar installations – 4 GW more than was installed by July of last year. Wood Mac forecasts that the number of solar projects larger than 120 MW commissioned in the U.S. will grow from 11 in 2019 to 32 in 2021.

The U.S. is estimated to have a utility-scale solar development pipeline of over 85 GW from 2020 through 2024.

So — despite a tariff on imports, a pandemic and some of the world’s most expensive utility-scale solar costs — 2020 should be the best year ever for big solar in the U.S.

Texas solar: look out, California

“Our biggest market will be in West Texas in the Permian Basin,” said George Hershman, president of EPC Swinerton Renewable Energy in an interview with pv magazine.

Texas is perfect for big solar. Although the state has no renewable portfolio standard, it does has Texas sun, lots of land and a deregulated and competitive energy-only marketplace. There’s also a developer-friendly permitting and interconnect process with real transmission capacity. Large Texas utilities, CPS Energy and Austin Energy, have RPS mandates.

A 2019 report from ERCOT found 43.5 GW of solar project applications in its interconnection queue, of which 5.1 GW had interconnection agreements and plans to complete construction by the end of 2020. Big Texas solar is forecast to grow from 4.6 GW to almost 14.5 GW over the next five years — second only to California in PV generation.

If you’re a growing utility-scale solar developer — you’re working in Texas.

Solar-plus-storage: hybrids everywhere

In 2019, 28% of utility-scale solar was paired with energy storage, according to Lawrence Berkeley National Laboratory.

That percentage is going to change very quickly.

“Everything in 2022 will have a storage component — the vast majority will have storage in 2021. Everything in California and the West, every contracted asset is going to have storage. We’re seeing the scale go up and cost go down — and we understand how to monetize it — it’s here to stay.” That’s the word on solar-plus-storage, according to Swinerton CEO George Hershman.

Battery retrofits on existing solar projects will only add to the ascendance of the hybrid renewable plant.

Import tariffs here a bit longer

The Section 201 tariff exemption for imported bifacial solar modules was repealed in November, meaning bifacial panels are now subject to a 20% penalty — the same tariff imposed on almost all imported crystalline silicon solar panels since 2018. The tariff is scheduled to drop to 18% in February of next year.

The Solar Energy Industries Association (SEIA) is opposed to these tariffs. In a recent press briefing, Abigail Ross Hopper, CEO of the trade organization, said, “We are asking President-elect Biden to remove those tariffs a year early.”

Although tariff relief is on the solar industry wish list, President-elect Biden, in an interview with The New York Times, said he would not act immediately to remove the tariffs that Trump imposed on about half of China’s exports to the U.S. “I’m not going to make any immediate moves, and the same applies to the tariffs,” he said. “I’m not going to prejudice my options.” Biden first wants to conduct a full review of the existing agreement with China and consult with our traditional allies in Asia and Europe, he said, “so we can develop a coherent strategy.”

In the second quarter, the average sales price of a monofacial PERC module in the U.S. market stood at $0.35/W, while the price outside the country fell to $0.23/W, according to IHS Markit.

Array Technologies goes public with a traditional IPO

This year witnessed a rarity — a solar hardware IPO.

Solar tracker builder Array Technologies went public on the Nasdaq with upwardly-revised IPO terms — giving it a fully-diluted market value of more than $2.5 billion.

Array went public the traditional way — rather than the SPAC route, common these days for venture-funded startups, cleantech and otherwise. Unlike many of the the SPAC companies, Array Technologies is actually growing its revenue and income in 2020 with expected 2020 revenues in the range of $845 million to $865 million.

Array is the No. 2 global solar tracker maker, behind Nextracker and ahead of PV Hardware, according to Wood Mackenzie. Trackers represent between 10% and 15% of the cost of building a ground-mounted solar energy project, and 70% of all ground-mounted solar projects constructed in the U.S. in 2019 used trackers according to BloombergNEF and IHS Markit, respectively.

Software, Sunrun eat the residential solar world

It took a pandemic, but the U.S. residential solar (and storage) industry has finally figured out how to lower customer acquisition costs — move everything online.

Over the course of this strange year, U.S. residential solar companies such as Sunrun, Vivint, Sunpower and Tesla claimed they could weather the Covid-19 storm with remote selling and new online strategies.

It turns out they were right.

BloombergNEF is forecasting that Americans will install a record 3 GW of solar on the roofs of their homes. BNEF forecasts another 3.6 GW to be installed in 2021.

The combination of online sales strategies and a new set of homebound, energy-curious customers has enabled the market to grow in a cataclysmic year. As we’ve reported, Covid-19’s sudden arrival put resiliency at the forefront of people’s minds and accelerated adoption of digital sales practices.

“We’re seeing a lot of success in the conversion to digital sales,” said Sunrun CEO Lynn Jurich in a quarterly earnings call. “We’ve taken how the industry would have evolved – probably in two years – and we’ve done it in a month. I’m very encouraged by this transition and what it can mean for acquisition costs.”

Sunrun acquired Vivint Solar in an all-stock transaction, in July. Ravi Manghani, WoodMac’s head of solar told pv magazine, “This acquisition, paired with Tesla’s announcement last week to provide some of the cheapest residential solar offerings, indicates that the market is longing for cost efficiencies.” The new company has a combined base of more than 500,000 customers, with over 3 GW of solar assets on the balance sheet.

This is an environment in which solar software companies are forming and getting funded. Here are a few:

- Aurora Solar, a SaaS startup that lets solar installers and financiers design and sell residential solar remotely, raised $50 million in a Series B.

- 17TeraWatts is a software platform meant to help installers improve the solar customer experience.

- Station A uses software to optimize renewable and DER deployment planning in the C&I building market and is creating a transactional platform for buyers and sellers.

- Terabase Energy looks to drive down utility-scale solar power prices using its software, automation and “digital-twin” modeling.

Never ending NEM fights

Public domain

Since the first net metering law was passed in Minnesota in 1983, grid-tied customers exporting power to the grid expect to be compensated “at the average retail utility energy rate.” And since that day 37 years ago, utilities across America have challenged the value that distributed rooftop solar provides to the grid.

There’s always a net metering (NEM) battle somewhere that pits ratepayers against power providers. Utah has seen one of the latest skirmishes.

Last month, the Utah Public Service Commission made a decision on the value of the rooftop solar in the state, lowering the current export rate from the average of 9.2¢/kWh, instead to summer and winter rates of 5.969 cents/kWh and 5.639 cents/kWh respectively. Utility Rocky Mountain Power was proposing that it pay an average price of 1.5¢/kWh for new customers starting in 2021, an 84% reduction. Vote Solar argued that the actual value of solar is 22.6¢/kWh, but called on regulators to abandon this rate structure entirely and move back to net metering.

Every utility, every utility commission and every solar advocate uses a different calculator when solving for the value of distributed solar.

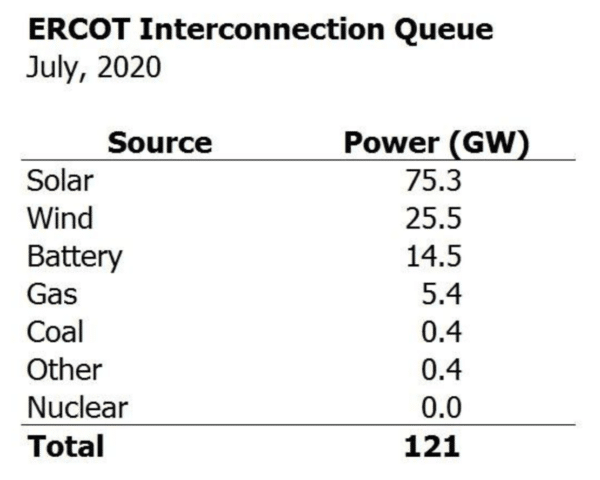

Interconnection queues reveal the glorious solar future

If you want a glimpse of the future of the clean energy transition in the United States, take a look at the interconnection queues in ERCOT, PJM and CAISO where solar, wind and storage dominate the list of projects applying to get on the grid in the coming years.

Of the 121 GW of new utility-scale generation applying to the Electric Reliability Council of Texas (ERCOT), the state’s grid operator, 75.3 GW are solar, 25.5 GW are wind and 14.5 GW are storage. Fossil fuels lag far behind, with natural gas at 5.4 GW and coal at 400 MW.

As California moves toward its goal of completely decarbonizing its grid by 2045, the state’s interconnection queue currently has only five natural gas projects on it, totaling about 819 MW compared to a whopping 87 GW of solar, wind and storage.

PJM Interconnection, the country’s largest grid operator, covering 13 Midwest and mid-Atlantic states and the District of Columbia, has 14.6 GW of fossil fuel generation in its interconnection queue versus 40 GW of solar.

Not every project on an interconnection queue will be completed and go online. But applying for and getting an interconnection agreement — a long, expensive process — is a key step in developing any new electric power generation.

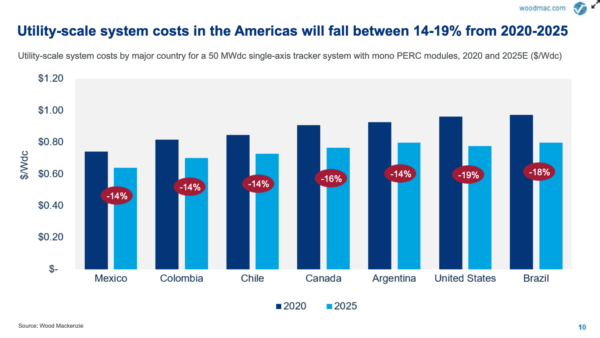

The PV price drop isn’t over

Utility-scale solar power prices below $0.01 per kWh by 2025 are within reach.

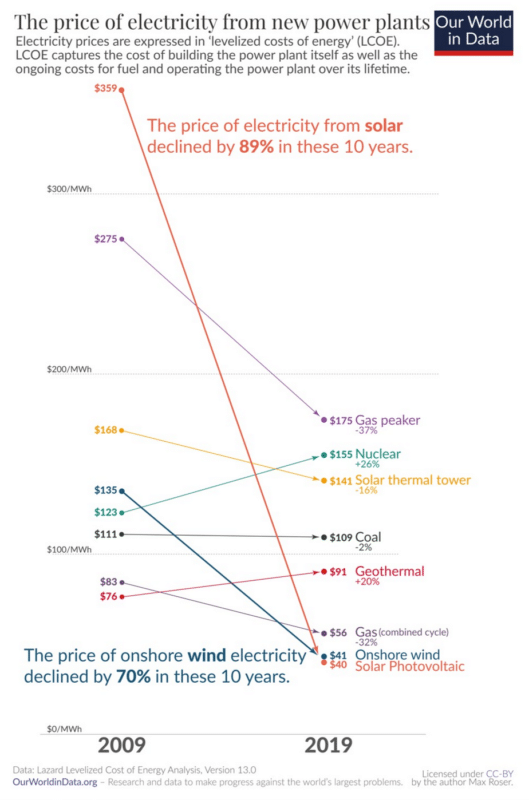

Using LCOE data from Lazard, Our World in Data shows that within the last ten years the price of electricity from nuclear has became more expensive, gas power has became less expensive, and the price of coal power – the world’s largest source of electricity – stayed almost the same.

The slope of the price of electricity from solar is remarkably steep and continuing to fall.

Solar stock prices soar

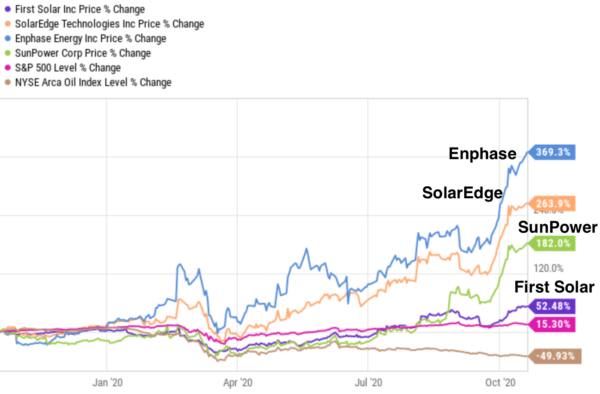

With strong financial performance during a pandemic and with strong demand for environmental, social and corporate governance (ESG) investments, SunPower and SolarEdge stocks have been on a tear this year. Growing revenue and profits have driven Enphase to new heights in the solar industry’s most dramatic corporate recovery and turnaround. Invesco’s Solar ETF has more than doubled.

Analysts at Cowen and Morgan Stanley believe that even with a split Congress, solar energy firms could benefit, with an opportunity for extended or enhanced tax credits. First Solar might face headwinds from an import tariff repeal.

Corporate procurement

Corporate renewable procurement is helping drive the growth of utility-scale solar in the U.S.

McDonald’s just passed the 1 GW mark in renewable capacity with a total of 583 MW of solar after signing three new virtual power purchase agreements. Google partnered with AES Corp. to drive solar and wind development in the U.S. Facebook and Rocky Mountain Power are working together to build 700 MW of solar in Utah. Amazon is the biggest corporate buyer of wind and solar power with the capacity to produce 3.4 GW of electricity.

AT&T announced that it had signed a 500 MW power purchase agreement for a portion of the enormous Samson solar project. At 1.3 GW upon completion (expected in 2023), the Samson Solar Energy Center will be the largest solar installation in the country and among the largest in the world. The rest of the project’s capacity is also contracted under corporate purchase agreements with Honda (200 MW), Google (100 MW), The Home Depot (50 MW). According to the 2019 Solar Means Business report, the top corporations in terms of purchased or owned solar capacity in 2019 were Apple (400 MW), Amazon (370 MW), Walmart (330) MW, Target (285 MW) and Google (245 MW).

This trend is not going away.

***

Here’s to finding connection and meaning in 2020 and to a fantastic 2021.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

ERCOT’s November data shows 81.1GW of solar, 23.9GW wind, 21.4GW battery and 7.2GW of gas – but the gas includes 324MW of compressed air storage which you would think would be better in their Other->Battery category.

Of that, the amount with IAs is 17.5GW solar, 13.2GW wind, 2GW NG and 1.6GW of batteries.

Through Sept coal generation in Texas has fallen over 19% this year as electric generation has only dropped 2%. And it will get a lot worse for coal in the next few years as massive amounts of solar get built. Wind was up 10.2%, solar up 72.3% and ng was down 1.1%.

It will take a few years, but when solar catches up to wind in Texas it will be great for the air there. Certainly by 2030, but probably a lot sooner. I would bet 5-7 years.

The government has also suggested people use solar products. This is great blessings to us in this Era. In this method, electricity also reaches there where it is not possible. By the way nice article published by you sir