Third-party solar is a funny business. The amassing of portfolios of solar on the roofs of customers while lease and PPA payments slowly roll in means that any company in this space is something of a vehicle for both borrowing and shelling out cash, and as such it’s difficult to evaluate which companies are getting ahead and which are more shell games.

And while we’ve expressed concern about the finances of several third-party solar companies and the model writ large over the last year, in this latest quarter Sunnova showed incremental improvement. As is consistently the case with third party solar companies Sunnova showed a net loss, this quarter at $34 million, but unlike last quarter its revenues were in excess of its interest payments.

The company is also growing. Sunnova’s $37 million in quarterly revenues is 20% higher than a year ago, and during the third quarter the company added 5,000 new customers, a 48% year-over-year increase. Overall Sunnova deployed 39 MW during the quarter, which puts it within striking distance of Tesla in deployment volume but well behind third-party peers Sunrun and Vivint.

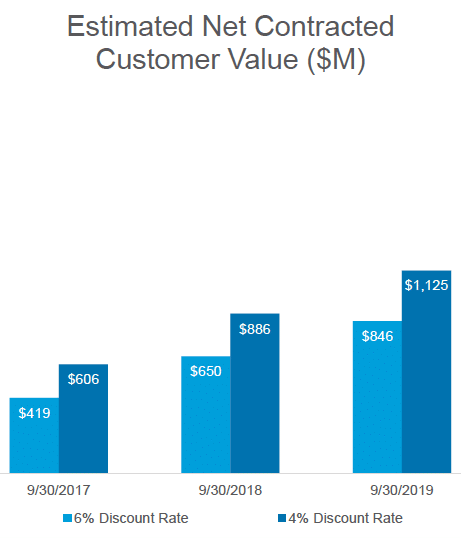

Sunnova’s growth may be attributed to the increase in its dealer network. The company now boasts 136 dealers and sub-dealers, more than double what it had a year ago. And by now it has amassed a neat $1.6 billion in PV assets, with another $141 million under construction. The company calculates that this represents between $846 million and $1.1 billion in net contracted value, depending on the discount rate used.

Sunnova’s growth may be attributed to the increase in its dealer network. The company now boasts 136 dealers and sub-dealers, more than double what it had a year ago. And by now it has amassed a neat $1.6 billion in PV assets, with another $141 million under construction. The company calculates that this represents between $846 million and $1.1 billion in net contracted value, depending on the discount rate used.

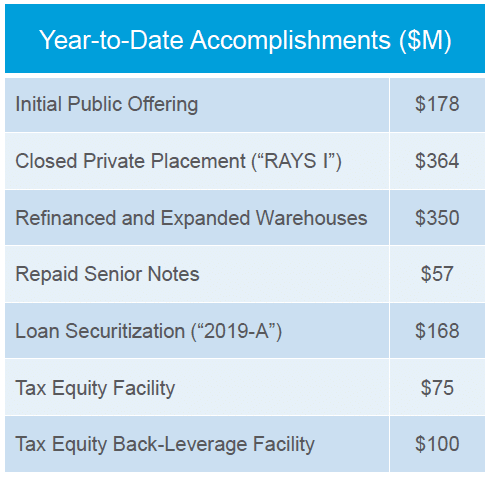

But as is always the case with third-party solar, the most important metric is whether or not the company can raise enough cash to keep afloat. And here Sunnova appears to be doing fine. During the third quarter Sunnova brought in $201 million in cash through various financing activities in Q3, and around $486 million in the first three quarters of this year. This put the company at $109 million in cash & equivalents at the end of the third quarter, meaning a comfortable level of padding.

And this is just the beginning. In 2020 Sunnova expects to do five securitizations, noting that each successive securitization has been done with a better rate than the previous ones.

And this is just the beginning. In 2020 Sunnova expects to do five securitizations, noting that each successive securitization has been done with a better rate than the previous ones.

With Roth Capital expecting the U.S. residential solar market to grow 25% next year, there is plenty of room for multiple companies and business models. And Sunnova is taking an increasing slice of that pie.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.